How to integrate Uniswap 4 and create custom hooks

Let's dive into Uniswap v4's new features and integration

Uniswap v4 adds several key updates to improve gas efficiency, customizability, and functionality.

So let's not lose time and dive into it!

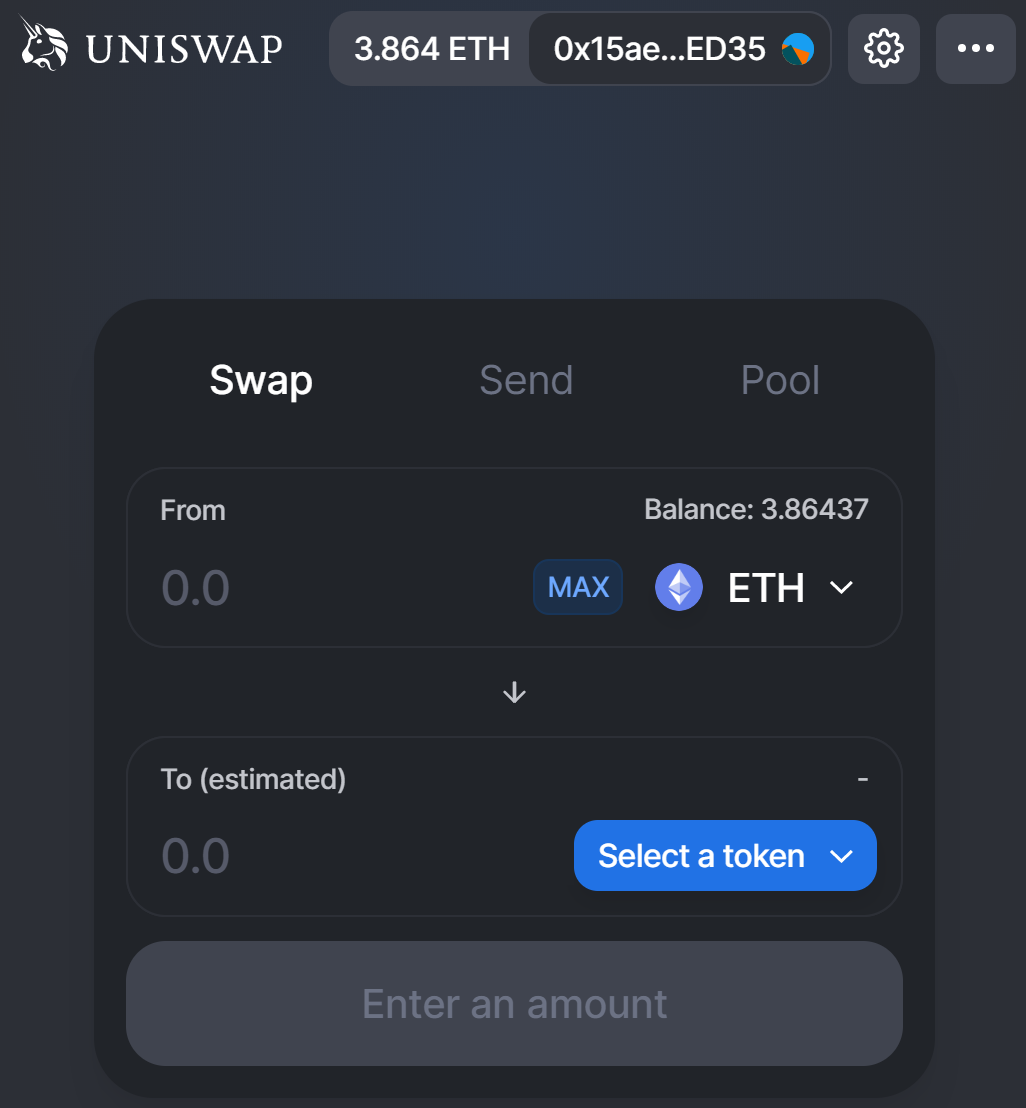

By now you've probably heard of Uniswap and so-called AMMs (automated market makers). But if you're not familiar with Uniswap yet, it's a fully decentralized protocol for automated liquidity provision on Ethereum. An easier-to-understand description would be that it's a decentralized exchange (DEX) relying on external liquidity providers that can add tokens to smart contract pools and users can trade those directly.

Since it's running on Ethereum, what we can trade are Ethereum ERC-20 tokens and ETH. Originally for each token there was its own smart contract and liquidity pool, now in Uniswap 4 there is one smart contract that manages the state for all pools. A pool is any two tokens with some customizations for what fees and hooks. We'll discuss this later in more detail.

Uniswap - being fully decentralized - has no restrictions to which tokens can be added. If no pools for a token pair + customization exist yet, anyone can create one and anyone can provide liquidity to a pool.

The price of a token is determined by the liquidity in a pool. For example if a user is buying TOKEN1 with TOKEN2, the supply of TOKEN1 in the pool will decrease while the supply of TOKEN2 will increase and the price of TOKEN1 will increase. Likewise, if a user is selling TOKEN1, the price of TOKEN1 will decrease. Therefore the token price always reflects the supply and demand. This behavior can be described using the known formula: x * y = k.

And of course a user doesn't have to be a person, it can be a smart contract. That allows us to add Uniswap to our own contracts for adding additional payment options for users of our contracts. Uniswap makes this process very convenient, see below for how to integrate it.

What is new in UniSwap v4?

We've discussed what's new in Uniswap v3 here, but now let's see what's new in Uniswap v4:

Hooks: At the heart of Uniswap v4 is a new concept known as 'hooks'. Think of hooks like plugins you can add to your music software to create a new sound effect. Similarly, these hooks can be used to add new functionalities or features to the liquidity pools in Uniswap v4. In practical terms, hooks can enable a variety of functions like setting up limit orders, dynamic fees or creating custom oracle implementations. We'll take a closer look at this feature!

Singleton and Flash Accounting: In previous versions, every new token pair had its own contract. However, Uniswap v4 introduces the singleton design pattern, meaning all pools are managed by a single contract. And Uniswap v4 uses a system called 'flash accounting'. This method only transfers tokens externally at the end of a transaction, updating an internal balance throughout the process. All this improves gas costs a lot.

Native ETH: Uniswap v4 is bringing back support for native ETH. So, instead of wrapping your ETH into an ERC-20 token for trading, you can trade directly using ETH. Another feature for saving gas.

ERC1155 Accounting: With Uniswap v4, you can keep your tokens within the singleton (that mega contract we talked about earlier) and avoid constant transfers to and from the contract. The accounting itself uses the ERC1155 standard which is a multi-token standard. It allows you to send multiple different token classes in one transaction. We've discussed the standard here before.

Governance Updates: Uniswap v4 also brings changes to how fees are managed. There are two separate governance fee mechanisms - swap fees and withdrawal fees. The governing body can take a certain percentage of these fees.

Donate Function: Uniswap v4 introduces a

donatefunction that allows users to pay liquidity providers directly in the tokens of the pool.

Further Resources

What happens to Uniswap v3?

Integrating UniSwap v4

Doing a swap within your contracts is now a little more complex in Uniswap 4. So let's take a look at one example:

- We'll import the contracts directly via URL, so you could take this example and plug it right into Remix.

- We're working with the code from commit

blob/86b3f657, make sure to update this to/blob/mainto get the latest version.

Let's investigate the swapTokens function that takes in three parameters:

IPoolManager.PoolKey poolKeyIPoolManager.SwapParams calldata swapParamsuint256 deadline

The poolKey is the identifier for which pool you want to use for the swap. This not only consists of the two token addresses, but also of the specified fees, tick spacing and hooks:

struct PoolKey {

Currency currency0;

Currency currency1;

uint24 fee;

int24 tickSpacing;

IHooks hooks;

}That means there will be an infinite amount of pools per token pair now! It will be up to you to determine which ones to use.

The currency here is actually using the new Solidity feature of custom types:

type Currency is address;So in other words Currency is just an address type. Typically an ERC20 token address. So why not IERC20? Because Currency can also mean native ETH. In this case you have to pass address(0).

As for the IHooks, we'll discuss this in greater details later.

Now the second parameter we send is SwapParams which consists of:

- zeroForOne: A boolean indicating the direction (buy vs. sell)

- amountSpecified: The actual amount you want to swap.

- sqrtPriceLimitX96: This represents the lowest price you are fine to accept. It's represented as the square root of the

x * yformula. And X96 refers to this being represented as a fixed-point decimal with 96 bits of precision to the right of the decimal point.

struct SwapParams {

bool zeroForOne;

int256 amountSpecified;

uint160 sqrtPriceLimitX96;

}Now we look at the flow from swapTokens next, here's where some magic happens. swapTokens calls the lock function on the poolManager. By calling lock, you're asking Uniswap to allow trading against it.

This allows Uniswap to allow you to get negative balances. Why?

As soon as the lock is called, the poolManager contract from Uniswap automatically calls lockAcquired on your contract again. Inside here we can do all the trades and interaction we want. After the call to lockAcquired is finished (so your code is done executing), Uniswap does one last check still:

if (lockState.nonzeroDeltaCount != 0) {

revert CurrencyNotSettled();

}So at the end of it all, you must have settled your balances again. This keeps token transfers to an absolute minimum, because we have to do it only once at the end.

The function _settleCurrencyBalance is called for each currency involved in the swap. If we have a negative delta it means the pool still owes us money. We can take it back by calling take.

In the other case we have to pay back the amount using settle:

- For ETH we can just send the amount directly along with the

settlecall. - For ERC20 tokens we have to transfer them to the pool manager and then call

settleseparately.

// SPDX-License-Identifier: MIT

pragma solidity >=0.8.19;

// make sure to update latest 'main' branch on Uniswap repository

import {

IPoolManager, BalanceDelta

} from "https://github.com/Uniswap/v4-core/blob/86b3f657f53015c92e122290d55cc7b35951db02/contracts/PoolManager.sol";

import {

CurrencyLibrary,

Currency

} from "https://github.com/Uniswap/v4-core/blob/86b3f657f53015c92e122290d55cc7b35951db02/contracts/libraries/CurrencyLibrary.sol";

import {IERC20} from

"https://github.com/OpenZeppelin/openzeppelin-contracts/blob/v4.9.2/contracts/token/ERC20/IERC20.sol";

import {SafeERC20} from

"https://github.com/OpenZeppelin/openzeppelin-contracts/blob/v4.9.2/contracts/token/ERC20/utils/SafeERC20.sol";

error SwapExpired();

error OnlyPoolManager();

using CurrencyLibrary for Currency;

using SafeERC20 for IERC20;

contract UniSwapTest {

IPoolManager public poolManager;

constructor(IPoolManager _poolManager) {

poolManager = _poolManager;

}

function swapTokens(

IPoolManager.PoolKey calldata poolKey,

IPoolManager.SwapParams calldata swapParams,

uint256 deadline

) public payable {

poolManager.lock(abi.encode(poolKey, swapParams, deadline));

}

function lockAcquired(uint256, bytes calldata data) external returns (bytes memory) {

if (msg.sender == address(poolManager)) {

revert OnlyPoolManager();

}

(

IPoolManager.PoolKey memory poolKey,

IPoolManager.SwapParams memory swapParams,

uint256 deadline

) = abi.decode(data, (IPoolManager.PoolKey, IPoolManager.SwapParams, uint256));

if (block.timestamp > deadline) {

revert SwapExpired();

}

BalanceDelta delta = poolManager.swap(poolKey, swapParams);

_settleCurrencyBalance(poolKey.currency0, delta.amount0());

_settleCurrencyBalance(poolKey.currency1, delta.amount1());

return new bytes(0);

}

function _settleCurrencyBalance(

Currency currency,

int128 deltaAmount

) private {

if (deltaAmount < 0) {

poolManager.take(currency, msg.sender, uint128(-deltaAmount));

return;

}

if (currency.isNative()) {

poolManager.settle{value: uint128(deltaAmount)}(currency);

return;

}

IERC20(Currency.unwrap(currency)).safeTransferFrom(

msg.sender,

address(poolManager),

uint128(deltaAmount)

);

poolManager.settle(currency);

}

}And voila! Your tokens have been swapped.

function lock(bytes calldata data) public payable {

poolManager.lock(data);

}

function lockAcquired(uint256, bytes calldata data) external returns (bytes memory) {

if (msg.sender == address(poolManager)) {

revert OnlyPoolManager();

}

(bool success, bytes memory returnData) = address(this).call(data);

if (success) return returnData;

if (returnData.length == 0) revert LockFailure();

assembly {

revert(add(returnData, 32), mload(returnData))

}

}

function swapTokens(

IPoolManager.PoolKey calldata poolKey,

IPoolManager.SwapParams calldata swapParams,

uint256 deadline

) external returns (bytes memory) {

// old logic from the previous `lockAcquired`

}An alternative architecture to the above one that's slightly more flexible could also be this one on the left.

Here we're basically just passing any data from the caller to the lock which is then passed to the lockAcquired. From there we simply call address(this).call(data).

In our case the data then to execute swapTokens should be the swapTokens function signature combined with its input parameters.

Entering a New Uniswap Era with Hooks

Now let's discuss the biggest new feature, the hooks. There are three different hook interfaces available.

The first and biggest one is IHooks:

interface IHooks {

function beforeInitialize(address sender, PoolKey calldata key, uint160 sqrtPriceX96) external returns (bytes4);

function afterInitialize(address sender, PoolKey calldata key, uint160 sqrtPriceX96, int24 tick) external returns (bytes4);

function beforeModifyPosition(address sender, PoolKey calldata key, ModifyPositionParams calldata params) external returns (bytes4);

function afterModifyPosition(address s, PoolKey calldata k, ModifyPositionParams calldata p, BalanceDelta d) external returns (bytes4);

function beforeSwap(address sender, PoolKey calldata key, SwapParams calldata params) external returns (bytes4);

function afterSwap(address sender, PoolKey calldata key, SwapParams calldata params, BalanceDelta delta) external returns (bytes4);

function beforeDonate(address sender, PoolKey calldata key, uint256 amount0, uint256 amount1) external returns (bytes4);

function afterDonate(address sender, PoolKey calldata key, uint256 amount0, uint256 amount1) external returns (bytes4);

}The IHooks interface in Uniswap 4 provides you with an option to interact with different stages of transactions in your liquidity pools. You can consider hooks as operations that get triggered before and after key operations in your pool.

beforeInitializeandafterInitialize: When a new pool is initialized, e.g. if you want to add some additional setup logic when creating a new pool, this is the place.beforeModifyPositionandafterModifyPosition: When an LP position in a pool is being changed, in other words every time an LP adds/removes liquidity or changes parameters of his LP position.beforeSwapandafterSwap: Before and after a swap operation happens. You can see the flow on the right.beforeDonateandafterDonate: When liquidity is being added to the pool via the newdonatefunction.

Remember, you don't need to implement all the hooks. Depending on your requirements, you can choose to implement only those that you need.

We'll explore how you can add these hooks to a pool soon, but first let's take a look at two other hook interfaces.

interface IHookFeeManager {

function getHookSwapFee(

IPoolManager.PoolKey calldata key

) external view returns (uint8);

function getHookWithdrawFee(

IPoolManager.PoolKey calldata key

) external view returns (uint8);

}The IHookFeeManager is a separate interface from the IHooks related to allowing a hook itself to take some fee.

getHookSwapFee: This method allows a hook to define how much cut a hook should get when a swap happens.getHookWithdrawFee: This method sets how much a hook can charge when assets are withdrawn from the pool.

Lastly the IDynamicFeeManager interface is used for determining the regular swap fees:

getFee: This method returns the dynamic fee for a pool. This allows for more flexible and potentially changing fee structures, e.g. you could base fees on factors like market conditions.

interface IDynamicFeeManager {

function getFee(

IPoolManager.PoolKey calldata key

) external returns (uint24);

}Now those hooks in total are available.

But how do you now create a pool with custom hooks?

Creating Custom Uniswap 4 Hooks

Well the short answer is, you can use this new template I created for foundry as a starting point:

$ forge init my-project --template https://github.com/soliditylabs/uniswap-v4-custom-poolAnd check out the repository over at https://github.com/soliditylabs/uniswap-v4-custom-pool.

But now to the longer answer with some explanations. There are two different mechanisms for how the fees are executed:

- The prefix of the deployed Ethereum address itself of your Hooks contract.

- Special flags in the fee definition, if set to 1, will trigger the specific fee hook.

Let's start with the first one. There's a bit of magic in here, but it's not too hard.

IHooks has 8 defined hook functions. Each function corresponds to a bit in the beginning of your Ethereum address.

What do we mean with that?

Imagine you have a random address like 0x480f0d4887ed4f16d2299031dffec90782826269. The first two characters `0x48` represented in binary will be 01001000.

This will result in the hooks afterInitialize and beforeSwap being executed.

If you want to run all hooks for example, you must make sure that your deployed address starts with `0xff`.

Now the next question is, how do you ensure that the address starts with the correct bits?

Usually the address of a deployed contract will be a combination of the deployer address, its transaction nonce and the deployed bytecode. That would make deployments quite challenging.

Fortunately Ethereum has a second way to deploy contracts using the CREATE2 opcode.

Deploying Hook at the Correct Address

contract UniswapHooksFactory {

function deploy(

address owner,

IPoolManager poolManager,

bytes32 salt

) external returns (address) {

return address(new MyHooksContract{salt: salt}(owner, poolManager));

}

function getPrecomputedHookAddress(

address owner,

IPoolManager pm,

bytes32 salt

) external view returns (address) {

bytes32 bytecodeHash = keccak256(abi.encodePacked(

type(UniswapHooks).creationCode, abi.encode(owner, pm)

));

bytes32 hash = keccak256(

abi.encodePacked(bytes1(0xff), address(this), salt, bytecodeHash)

);

return address(uint160(uint256(hash)));

}

}CREATE2 deployments take in a salt parameter. In Solidity this can be done by simply adding {salt: salt} to the deployment call.

This allows for deterministic addresses that are not based on the transaction nonce and deployer address anymore. Instead it depends solely on the salt and contract bytecode.

We can then also easily precompute what the address of such a Hook would be. Note that the 0xff here is a different concept and has nothing to do with the hooks. You can read the CREATE2 EIP here, to learn more on this.

Given this easy way to determine the address, to deploy our hooks we only need to find the correct salt that gives us the address we want. This is a small brute-force effort.

If you're using Foundry, you can add something like this to your deploy script:

for (uint256 i = 0; i < 1500; i++) {

bytes32 salt = bytes32(i);

address expectedAddress = uniswapHooksFactory.getPrecomputedHookAddress(owner, poolManager, salt);

if (_doesAddressStartWith(expectedAddress, 0xff)) {

IHooks(uniswapHooksFactory.deploy(owner, poolManager, salt));

}

}

function _doesAddressStartWith(address _address,uint160 _prefix) private pure returns (bool) {

return uint160(_address) / (2 ** (8 * (19))) == _prefix;

}This will ensure you're deploying with the correct salt!

import {Hooks} from "@uniswap/v4-core/contracts/libraries/Hooks.sol";

constructor(IPoolManager _poolManager) {

poolManager = _poolManager;

validateHookAddress(this);

}

function validateHookAddress(BaseHook _this) internal pure {

Hooks.validateHookAddress(_this, getHooksCalls());

}

function getHooksCalls() public pure returns (Hooks.Calls memory) {

return Hooks.Calls({

beforeInitialize: true,

afterInitialize: true,

beforeModifyPosition: true,

afterModifyPosition: true,

beforeSwap: true,

afterSwap: true,

beforeDonate: true,

afterDonate: true

});

}Now as a last way to verify you have set the address correctly, we can use the Hooks.validateHookAddress function provided by Uniswap.

Inside the constructor of our Hook we can call validateHookAddress with the booleans set exactly to those hooks we want to have registered.

If the address doesn't match this specification, the deployment will fail.

For example on the left it would only succeed if the address actually starts with `0xff`, because we have set all hooks to be required.

Setting Fee Hooks

Now the mechanism for the fee hooks is slightly different.

When you initialize a pool in the poolManager, you have to call something like on the right. If you want the fee hooks to be executed, you have to set the specific flags here for myFees, if not you would put a static fee number here.

poolManager.initialize(IPoolManager.PoolKey({

currency0: Currency.wrap(address(token1)),

currency1: Currency.wrap(address(token2)),

fee: myFees,

tickSpacing: 1,

hooks: IHooks(deployedHooks)

}), sqrtPriceX96);For example if you want all fee hooks to be executed, you would just set all flags by setting myFees like this:

uint24 myFees = Fees.DYNAMIC_FEE_FLAG + Fees.HOOK_SWAP_FEE_FLAG + Fees.HOOK_WITHDRAW_FEE_FLAG;That's it! You can dive into the full examples over at https://github.com/soliditylabs/uniswap-v4-custom-pool.

And use them as a starting point in Foundry like this:

$ forge init my-project --template https://github.com/soliditylabs/uniswap-v4-custom-poolAnd also worth noting, you can find some examples for implemented hooks here: https://github.com/Uniswap/v4-periphery/tree/main/contracts/hooks/examples.

One interesting example is the feature to enable limit orders. On a high level it works as follows. The hook contract has two functions:

function placeLimitOrder(PoolKey calldata key, int24 tickLower, bool zeroForOne, uint128 liquidity): Allow users to add liquidity to the hook at specified ticks.function afterSwap: Inside the hook, we can check the new ticks and modify the hook's LP position accordingly.

That's it. You've reached the end. Now good luck on your Uniswap journey.

Onwards and upwards.

Solidity Developer

More great blog posts from Markus Waas

How to use ChatGPT with Solidity

Using the Solidity Scholar and other GPT tips

Welcome your new best friend as a Solidity developer: ChatGPT. If you're a developer and not using ChatGPT yet, then what the hell are you doing? Let's explore some unique ways this can help you as a Solidity developer. You can just chat directly with ChatGPT or you can use custom GPTs. I have...

How to integrate Wormhole in your smart contracts

Entering a New Era of Blockchain Interoperability

Wormhole began as a token bridge between Ethereum and Solana and has since expanded into a decentralized interoperability protocol for multiple blockchain ecosystems. Wormhole now supports many chains like Ethereum, Cosmos, Polkadot, Injective and many more. It makes cross-chain communication...

Solidity Deep Dive: New Opcode 'Prevrandao'

All you need to know about the latest opcode addition

Let’s back up for a second and figure out what has changed since ‘ The Merge ’. The upgrade finally brought a new consensus mechanism to Ethereum. Instead of the old Proof of Work, blocks are now produced via Proof of Stake . Proof of Work finds consensus via block hashes and a process called...

How Ethereum scales with Arbitrum Nitro and how to use it

A blockchain on a blockchain deep dive

Have you heard of Arbitrum Nitro? The new WAVM enables Plasma but for smart contracts in a super efficient way! It enables having a side chain with guarantees of the Ethereum mainnet chain. Arbitrum has already been one of the most successful Layer 2s so far, and the new Nitro is a major upgrade...

The Ultimate Merkle Tree Guide in Solidity

Everything you need to know about Merkle trees and their future

Most of you probably have heard of Merkle trees by now. They are used everywhere in the world of blockchain. But are you really sure exactly How they work? What the best ways to use them are? What the future holds for Merkle trees? This is not a Merkle tree. What are Merkle Trees? Ralph Merkle...

The New Decentralized The Graph Network

What are the new features and how to use it

Quite some time has passed since my last post about The Graph. If you don't know what it is and why it's useful, go and read the post. It's still relevant and explains in detail why it's needed and how to use it with the centralized hosted service. But the tl;dr is: Events on a blockchain are a...

zkSync Guide - The future of Ethereum scaling

How the zero-knowledge tech works and how to use it

Have you heard of zkSync and its new zkEVM? The new zkSync EVM enables Zero-knowledge proofs for any smart contract executions. What does that mean? Well read on later. But what it enables is having a side chain with similar (not not exact) guarantees of the Ethereum mainnet chain. How cool is...

Exploring the Openzeppelin CrossChain Functionality

What is the new CrossChain support and how can you use it.

For the first time Openzeppelin Contracts have added CrossChain Support. In particular the following chains are currently supported: Polygon: One of the most popular sidechains right now. We've discussed it previously here. Optimism: A Layer 2 chain based on optimistic rollups. We discussed the...

Deploying Solidity Contracts in Hedera

What is Hedera and how can you use it.

Hedera is a relatively new chain that exists since a few years, but recently added token service and smart contract capabilities. You can now write and deploy Solidity contracts to it, but it works a little differently than what you might be used to. Let's take a look! What is the Hedera Network?...

Writing ERC-20 Tests in Solidity with Foundry

Blazing fast tests, no more BigNumber.js, only Solidity

Maybe you are new to programming and are just starting to learn Solidity? One annoyance for you might have been that you were basically required to learn a second language (JavaScript/TypeScript) to write tests. This was undoubtedly a downside which is now gone with the new foundry framework. But...

ERC-4626: Extending ERC-20 for Interest Management

How the newly finalized standard works and can help you with Defi

Many Defi projects have an ERC-20 token which represents ownership over an interest generating asset. This is for example the case for lending/borrowing platforms (money markets) like Compound and Aave. As a lender you will receive aDAI or cDAI. And since lenders receive interest payments for...

Advancing the NFT standard: ERC721-Permit

And how to avoid the two step approve + transferFrom with ERC721-Permit (EIP-4494)

There's a new standard in the making. To understand how this really works, I recommend you take a look at my tutorials on: ERC721 ERC20-Permit ecrecover incl EIP712 But we'll try to cover the basics here also. You might be familiar already with ERC20-Permit (EIP-2612). It adds a new permit...

Moonbeam: The EVM of Polkadot

Deploying and onboarding users to Moonbeam or Moonriver

We've covered several Layer 2 sidechains before: Polygon xDAI Binance Smart Chain Evmos Aurora (NEAR) But Moonbeam is unique since it's a parachain of the Polkadot ecosystem. It only just launched which means you are now able to deploy smart contracts to the chain. Being able to deploy EVM...

Advanced MultiSwap: How to better arbitrage with Solidity

Making multiple swaps across different decentralized exchanges in a single transaction

If you want maximum arbitrage performance, you need to swap tokens between exchanges in a single transaction. Or maybe you just want to save gas on certain swaps you perform regularly. Or maybe you have your own custom use case for swapping between decentralized exchanges. And of course maybe you...

Deploying Solidity Smart Contracts to Solana

What is Solana and how can you deploy Solidity smart contracts to it?

Solana is a new blockchain focusing on performance. It supports smart contracts like Ethereum which they call Programs. You can develop those in Rust, but there's also a new project now to compile Solidity to Solana. In other words you can deploy your contracts written in Solidity now to Solana!...

Smock 2: The powerful mocking tool for Hardhat

Features of smock v2 and how to use them with examples

We’ve covered mocking contracts before as well as the first version of the new mocking tool Smock 2. It simplifies the mocking process greatly and also gives you more testing power. You’ll be able to change the return values for functions as well as changing internal contract storage directly!...

How to deploy on Evmos: The first EVM chain on Cosmos

Deploying and onboarding users to Evmos

We've covered several Layer 2 sidechains before: Polygon xDAI Binance Smart Chain Aurora Chain (NEAR) Optimism But this time we will do into the exciting new world of Cosmos. Many of the most interesting projects are currently building in the ecosystem and you can expect a lot to happen here in...

EIP-2535: A standard for organizing and upgrading a modular smart contract system.

Multi-Facet Proxies for full control over your upgrades

The EIP-2535 standard has several projects already using it, most notably Aavegotchi holding many millions of dollars. What is it and should you use it instead of the commonly used proxy upgrade pattern? What is a diamond? We're not talking about diamond programmer hands here of course. A diamond...

MultiSwap: How to arbitrage with Solidity

Making multiple swaps across different decentralized exchanges in a single transaction

If you want maximum arbitrage performance, you need to swap tokens between exchanges in a single transaction. Or maybe you just want to save gas on certain swaps you perform regularly. Or maybe you have your own custom use case for swapping between decentralized exchanges. And of course maybe you...

The latest tech for scaling your contracts: Optimism

How the blockchain on a blockchain works and how to use it

Have you heard of Optimism? The new Optimistic VM enables Plasma but for smart contracts! What does that mean? Well read on. But what it enables is having a side chain with guarantees of the Ethereum mainnet chain. How cool is that? And you can already use it for several apps on mainnet....

Ultimate Performance: The Aurora Layer2 Network

Deploying and onboarding users to the Aurora Network powered by NEAR Protocol

We've covered several Layer 2 sidechains before: Polygon xDAI Binance Smart Chain But today might be the fastest of them all. On top it's tightly connected to the NEAR protocol ecosystem, a PoS chain with a scalable sharding design. And of course they have a bridge to Ethereum! What is the Aurora...

What is ecrecover in Solidity?

A dive into the waters of signatures for smart contracts

Ever wondered what the hell the deal is with the ecrecover command in Solidity? It's all about signatures and keys... What is ecrecover ? You may have seen ecrecover in a Solidity contract before and wondered what exactly the deal with this was. Well you came across the EVM precompile ecrecover....

How to use Binance Smart Chain in your Dapp

Deploying and onboarding users to the Binance Smart Chain (BSC)

Defi has been a major contributor to the Binance Smart Chain taking off recently. Along with increasing gas costs on Ethereum mainnet which are actually at one of the lowest levels since a long time at the time of this writing, but will likely pump again at the next ETH price pump. So how does...

Using the new Uniswap v3 in your contracts

What's new in Uniswap v3 and how to integrate Uniswap v3

If you're not familiar with Uniswap yet, it's a fully decentralized protocol for automated liquidity provision on Ethereum. An easier-to-understand description would be that it's a decentralized exchange (DEX) relying on external liquidity providers that can add tokens to smart contract pools and...

What's coming in the London Hardfork?

Looking at all the details of the upcoming fork

The Berlin Hardfork only just went live on April 14th after block 12,224,00. Next up will be the London Hardfork in July which will include EIP-1559 and is scheduled for July 14th (no exact block decided yet). So let's take a look at the new changes and what you need to know as a developer....

Welcome to the Matrix of blockchain

How to get alerted *before* getting hacked and prevent it

Defi hacks alone have totaled $285M just since 2019. Let's take the Balancer hack for example. The hack was exploiting the fact that a pool with a deflationary token STA (Statera) was created. The pool accumulated a significant liquidity when it was eventually drained by the hack. Read my post on...

The Ultimate Ethereum Mainnet Deployment Guide

All you need to know to deploy to the Ethereum mainnet

We all love Ethereum, so you've built some great smart contracts. They are tested intensely with unit-tests and on testnets. Now it's finally time to go to mainnet. But this is a tricky business... 1. What exactly is a deployment transaction? First let's quickly discuss what a contract deployment...

SushiSwap Explained!

Looking at the implementation details of SushiSwap

You've probably heard of SushiSwap by now. The Uniswap fork brought new features like staking and governance to the exchange. But how exactly are the contracts behind it working? It's actually not too difficult. Knowing how this works in detail will be a great way to learn about Solidity and...

Solidity Fast Track 2: Continue Learning Solidity Fast

Continuing to learn Solidity fast with the advanced basics

Previously we learned all of the basics in 20 minutes. If you are a complete beginner, start there and then come back here. Now we'll explore some more advanced concepts, but again as fast as possible. 1. Saving money with events We all know gas prices are out of control right now, so it's more...

What's coming in the Berlin Hardfork?

Looking at all the details of the upcoming fork

The Berlin Hardfork is scheduled for April 14th after block 12,224,00. Later to be followed by the London Hardfork in July which will include EIP-1559. So let's take a look at the new changes and what you need to know as a developer. EIP-2929: Increased gas costs for state access EIP-2929 will...

Using 1inch ChiGas tokens to reduce transaction costs

What are gas tokens and example usage for Uniswap v2

Gas prices have been occasionally above 1000 Gwei in the past in peak times. Given an ETH price of over 1000 USD, this can lead to insane real transaction costs. In particular this can be a pain when using onchain DEX's like Uniswap, resulting in hundreds of dollars transaction fees for a single...

Openzeppelin Contracts v4 in Review

Taking a look at the new Openzeppelin v4 Release

The Openzeppelin v4 contracts are now available in Beta and most notably come with Solidity 0.8 support. For older compiler versions, you'll need to stick with the older contract versions. The beta tag means there still might be small breaking changes coming for the final v4 version, but you can...

EIP-3156: Creating a standard for Flash Loans

A new standard for flash loans unifying the interface + wrappers for existing ecosystems

As we've discussed last week, flash loans are a commonly used pattern for hacks. But what exactly are they and how are they implemented in the contracts? As of right now each protocol has its own way of implementing flash loans. With EIP-3156 we will get a standardized interface. The standard was...

Tornado.cash: A story of anonymity and zk-SNARKs

What is Tornado.cash, how to use it and the future

With the recent Yearn vault v1 hack from just a few days ago, we can see a new pattern of hacks emerging: Get anonymous ETH via tornado.cash. Use the ETH to pay for the hack transaction(s). Use a flash loan to decrease capital requirements. Create some imbalances given the large capital and...

High Stakes Roulette on Ethereum

Learn by Example: Building a secure High Stakes Roulette

It's always best to learn with examples. So let's build a little online casino on the blockchain. We'll also make it secure enough to allow playing in really high stakes by adding a secure randomness generator. Let's discuss the overall design first. Designing the contract Before we program...

How to implement generalized meta transactions

We'll explore a powerful design for meta transactions based on 0x

Enabling meta transactions inside your contract is a powerful addition. Requiring users to hold ETH to pay for gas has always been and still is one of the biggest user onboarding challenges. Who knows how many more people would be using Ethereum right now if it was just a simple click? But...

Utilizing Bitmaps to dramatically save on Gas

A simple pattern which can save you a lot of money

As you may know the most expensive operation in Ethereum is storing data (SSTORE). So you should always look for ways to reduce the storage requirements. Let's explore a particularly useful one: Bitmaps. How to implement a simple Bitmap Let's assume we want to store 10 boolean values. Usually you...

Using the new Uniswap v2 as oracle in your contracts

How does the Uniswap v2 oracle function and how to integrate with it

We've covered Uniswap previously here. But let's go through the basics first again. What is UniSwap? If you're not familiar with Uniswap yet, it's a fully decentralized protocol for automated liquidity provision on Ethereum. An easier-to-understand description would be that it's a decentralized...

Smock: The powerful mocking tool for Hardhat

Features of smock and how to use them with examples

We’ve covered mocking contracts before, but now there’s an additional great tool available: smock. It simplifies the mocking process greatly and also gives you more testing power. You’ll be able to change the return values for functions as well as changing internal contract storage directly! How...

How to build and use ERC-721 tokens in 2021

An intro for devs to the uniquely identifying token standard and its future

The ERC-721 standard has been around for a while now. Originally made popular by blockchain games, it's more and more used for other applications like Defi. But what exactly is it? A non-fungible token (NFT) is a uniquely identifying token. The word non-fungible implies you cannot just replace...

Trustless token management with Set Protocol

How to integrate token sets in your contracts

With Set Protocol you can create baskets of tokens that give users different levels of exposure to underlying assets (currently only ERC-20 tokens). Set Protocol and their TokenSet functionality is the perfect example for making use of the new paradigm of Defi and composability. You can let...

Exploring the new Solidity 0.8 Release

And how to upgrade your contracts to Solidity 0.8

We are getting closer to that Solidity 1.0 release (unless of course after 0.9 comes 0.10). Now Solidity 0.8 has been released only 5 months after the 0.7 release! Let's explore how you can migrate your contracts today... New features & how to use them Let's look at the two big new features which...

How to build and use ERC-1155 tokens

An intro to the new standard for having many tokens in one

ERC-1155 allows you to send multiple different token classes in one transaction. You can imagine it as transferring Chinese Yuan and US Dollars in a single transfer. ERC-1155 is most commonly known for being used in games, but there are many more use cases for it. First of all though, what are...

Leveraging the power of Bitcoins with RSK

Learn how RSK works and how to deploy your smart contracts to it

I'm always interested in what other ways one can use their blockchain and Solidity skills. While many projects are still only in the planning or in testnet status, with Rootstock (RSK) you can transfer mainnet Bitcoins to an EVM sidechain and vice-versa already today. Utilizing the power of the...

Solidity Fast Track: Learn Solidity Fast

'Learn X in Y minutes' this time with X = Solidity 0.7 and Y = 20

You might be familiar with the Learn X in Y minutes. For example you could learn JavaScript in 20 minutes at https://learnxinyminutes.com/docs/javascript/. Unfortunately there is no equivalent for Solidity, but this is about to change. Do you have 20 minutes to learn all of the basics? We even...

Sourcify: The future of a Decentralized Etherscan

Learn how to use the new Sourcify infrastructure today

We all love Etherscan. It's a great tool to interact with contracts, read the source codes or just see the status of your transactions. But unfortunately as great as it is, we should not forget that it's a centralized service. The website could be taken down any day. This kind of defeats the...

Integrating the 0x API into your contracts

How to automatically get the best prices via 0x

How can you add 0x to your contracts to automatically convert between tokens? We have done this in a similar fashion before with Uniswap and Balancer. The 0x API has a bit of a twist. Let's take a look why... Why you want 0x in your contracts? It's simple: Okay, but seriously. Let's see why the...

How to build and use ERC-777 tokens

An intro to the new upgraded standard for ERC-20 tokens

The new upgraded standard for ERC-20 tokens is becoming more and more popular. It's fully backwards compatible, you can easily create one using the Openzeppelin contracts and there are many interesting new features not available in ERC-20. Should you upgrade from ERC-20? Well let's look into what...

COMP Governance Explained

How Compound's Decentralized Governance is working under the hood

You might have heard about the COMP token launch. With a current market cap of over 350 million USD, the token has accumulated massive value. But what is the actual utility of COMP? It's a governance token. Compound being a fully decentralized system (or at least on the way towards it), has a...

How to prevent stuck tokens in contracts

And other use cases for the popular EIP-165

Do you remember the beginning of the Dark Forest story? If not, let's look at it again: Somebody sent tokens to a smart contract that was not intended to receive tokens. This perfectly illustrates one of the issues not only with ERC-20 tokens, but generally with smart contracts. How can we find...

Understanding the World of Automated Smart Contract Analyzers

What are the best tools today and how can you use them?

As we all know, it's very difficult writing a complex, yet fully secure smart contract. Without the proper methods, chances are you will have many security issues. Automated security testing tools already exist and can be a great help. One of the main challenges for these tools is to maximize...

A Long Way To Go: On Gasless Tokens and ERC20-Permit

And how to avoid the two step approve + transferFrom with ERC20-Permit (EIP-2612)!

It's April 2019 in Sydney. Here I am looking for the Edcon Hackathon inside the massive Sydney university complex. It feels like a little city within a city. Of course, I am at the wrong end of the complex and I realize to get to the venue hosting the Hackathon I need to walk 30 minutes to the...

Smart Contract Testing with Waffle 3

What are the features of Waffle and how to use them.

Waffle has been a relatively recent new testing framework, but has gained a lot of popularity thanks to its simplicity and speed. Is it worth a try? Absolutely. I wouldn't run and immediately convert every project to it, but you might want to consider it for new ones. It's also actively being...

How to use xDai in your Dapp

Deploying and onboarding users to xDai to avoid the high gas costs

Gas costs are exploding again, ETH2.0 is still too far away and people are now looking at layer 2 solutions. Here's a good overview of existing layer 2 projects: https://github.com/Awesome-Layer-2/awesome-layer-2. Today we will take a closer look at xDai as a solution for your Dapp. What are...

Stack Too Deep

Three words of horror

You just have to add one tiny change in your contracts. You think this will take you only a few seconds. And you are right, adding the code took you less than a minute. All happy about your coding speed you enter the compile command. With such a small change, you are confident your code is...

Integrating the new Chainlink contracts

How to use the new price feeder oracles

By now you've probably heard of Chainlink. Maybe you are even participating the current hackathon? In any case adding their new contracts to retrieve price feed data is surprisingly simple. But how does it work? Oracles and decentralization If you're confused about oracles, you're not alone. The...

TheGraph: Fixing the Web3 data querying

Why we need TheGraph and how to use it

Previously we looked at the big picture of Solidity and the create-eth-app which already mentioned TheGraph before. This time we will take a closer look at TheGraph which essentially became part of the standard stack for developing Dapps in the last year. But let's first see how we would do...

Adding Typescript to Truffle and Buidler

How to use TypeChain to utilize the powers of Typescript in your project

Unlike compiled languages, you pretty much have no safeguards when running JavaScript code. You'll only notice errors during runtime and you won't get autocompletion during coding. With Typescript you can get proper typechecking as long as the used library exports its types. Most Ethereum...

Integrating Balancer in your contracts

What is Balancer and how to use it

What is Balancer? Balancer is very similar to Uniswap. If you're not familiar with Uniswap or Balancer yet, they are fully decentralized protocols for automated liquidity provision on Ethereum. An easier-to-understand description would be that they are decentralized exchanges (DEX) relying on...

Navigating the pitfalls of securely interacting with ERC20 tokens

Figuring out how to securely interact might be harder than you think

You would think calling a few functions on an ERC-20 token is the simplest thing to do, right? Unfortunately I have some bad news, it's not. There are several things to consider and some errors are still pretty common. Let's start with the easy ones. Let's take a very common token: ... Now to...

Why you should automatically generate interests from user funds

How to integrate Aave and similar systems in your contracts

If you're writing contracts that use, hold or manage user funds, you might want to consider using those funds for generating free extra income. What's the catch? That's right, it's basically free money and leaving funds unused in a contract is wasting a lot of potential. The way these...

How to use Polygon (Matic) in your Dapp

Deploying and onboarding users to Polygon to avoid the high gas costs

Gas costs are exploding again, ETH2.0 is still too far away and people are now looking at layer 2 solutions. Here's a good overview of existing layer 2 projects: https://github.com/Awesome-Layer-2/awesome-layer-2. Today we will take a closer look at Polygon (previously known as Matic) as a...

Migrating from Truffle to Buidler

And why you should probably keep both.

Why Buidler? Proper debugging is a pain with Truffle. Events are way too difficult to use as logging and they don't even work for reverted transactions (when you would need them most). Buidler gives you a console.log for your contracts which is a game changer. And you'll also get stack traces...

Contract factories and clones

How to deploy contracts within contracts as easily and gas-efficient as possible

The factory design pattern is a pretty common pattern used in programming. The idea is simple, instead of creating objects directly, you have an object (the factory) that creates objects for you. In the case of Solidity, an object is a smart contract and so a factory will deploy new contracts for...

How to use IPFS in your Dapp?

Using the interplanetary file system in your frontend and contracts

You may have heard about IPFS before, the Interplanetary File System. The concept has existed for quite some time now, but with IPFS you'll get a more reliable data storage, thanks to their internal use of blockchain technology. Filecoin is a new system that is incentivizing storage for IPFS...

Downsizing contracts to fight the contract size limit

What can you do to prevent your contracts from getting too large?

Why is there a limit? On November 22, 2016 the Spurious Dragon hard-fork introduced EIP-170 which added a smart contract size limit of 24.576 kb. For you as a Solidity developer this means when you add more and more functionality to your contract, at some point you will reach the limit and when...

Using EXTCODEHASH to secure your systems

How to safely integrate anyone's smart contract

What is the EXTCODEHASH? The EVM opcode EXTCODEHASH was added on February 28, 2019 via EIP-1052. Not only does it help to reduce external function calls for compiled Solidity contracts, it also adds additional functionality. It gives you the hash of the code from an address. Since only contract...

Using the new Uniswap v2 in your contracts

What's new in Uniswap v2 and how to integrate Uniswap v2

Note : For Uniswap 3 check out the tutorial here. What is UniSwap? If you're not familiar with Uniswap yet, it's a fully decentralized protocol for automated liquidity provision on Ethereum. An easier-to-understand description would be that it's a decentralized exchange (DEX) relying on external...

Solidity and Truffle Continuous Integration Setup

How to setup Travis or Circle CI for Truffle testing along with useful plugins.

Continuous integration (CI) with Truffle is great for developing once you have a basic set of tests implemented. It allows you to run very long tests, ensure all tests pass before merging a pull request and to keep track of various statistics using additional tools. We will use the Truffle...

Upcoming Devcon 2021 and other events

The Ethereum Foundation just announced the next Devcon in 2021 in Colombia

Biggest virtual hackathon almost finished First of all, the current HackMoney event has come to an end and it has been a massive success. One can only imagine what kind of cool projects people have built in a 30 days hackathon. All final projects can be seen at:...

The Year of the 20: Creating an ERC20 in 2020

How to use the latest and best tools to create an ERC-20 token contract

You know what an ERC-20 is, you probably have created your own versions of it several times (if not, have a look at: ERC-20). But how would you start in 2020 using the latest tools? Let's create a new ERC-2020 token contract with some basic functionality which focuses on simplicity and latest...

How to get a Solidity developer job?

There are many ways to get a Solidity job and it might be easier than you think!

You have mastered the basics of Solidity, created your first few useful projects and now want to get your hands on some real-world projects. Getting a Solidity developer job might be easier than you think. There are generally plenty of options to choose from and often times not a lot of...

Design Pattern Solidity: Mock contracts for testing

Why you should make fun of your contracts

Mock objects are a common design pattern in object-oriented programming. Coming from the old French word 'mocquer' with the meaning of 'making fun of', it evolved to 'imitating something real' which is actually what we are doing in programming. Please only make fun of your smart contracts if you...

Kickstart your Dapp frontend development with create-eth-app

An overview on how to use the app and its features

Last time we looked at the big picture of Solidity and already mentioned the create-eth-app. Now you will find out how to use it, what features are integrated and additional ideas on how to expand on it. Started by Paul Razvan Berg, the founder of sablier, this app will kickstart your frontend...

The big picture of Solidity and Blockchain development in 2020

Overview of the most important technologies, services and tools that you need to know

Now, I do not know about you, but I remember when I first started with Solidity development being very confused by all the tools and services and how they work in connection with one another. If you are like me, this overview will help you understand the big picture of Solidity development. As I...

Design Pattern Solidity: Free up unused storage

Why you should clean up after yourself

You may or may not be used to a garbage collectors in your previous programming language. There is no such thing in Solidity and even if there was a similar concept, you would still be better off managing state data yourself. Only you as a programmer can know exactly which data will not be used...

How to setup Solidity Developer Environment on Windows

What you need to know about developing on Windows

Using Windows for development, especially for Solidity development, can be a pain sometimes, but it does not have to be. Once you have configured your environment properly, it can actually be extremely efficient and Windows is a very, very stable OS, so your overall experience can be amazing. The...

Avoiding out of gas for Truffle tests

How you do not have to worry about gas in tests anymore

You have probably seen this error message a lot of times: Error: VM Exception while processing transaction: out of gas Disclaimer : Unfortunately, this does not always actually mean what it is saying when using Truffle , especially for older versions. It can occur for various reasons and might be...

Design Pattern Solidity: Stages

How you can design stages in your contract

Closely related to the concept of finite-state machines, this pattern will help you restrict functions in your contract. You will find a lot of situations where it might be useful. Any time a contract should allow function calls only in certain stages. Let's look at an example: contract Pool {...

Web3 1.2.5: Revert reason strings

How to use the new feature

A new Web3 version was just released and it comes with a new feature that should make your life easier. With the latest version 1.2.5, you can now see the the revert reason if you use the new handleRevert option. You can activate it easily by using web3.eth.handleRevert = true . Now when you use...

Gaining back control of the internet

How Ocelot is decentralizing cloud computing

I recently came across an ambitious company that will completely redefine the way we are using the internet. Or rather, the way we are using its underlying infrastructure which ultimately is the internet. While looking at their offering, I also learned how to get anonymous cloud machines, you...

Devcon 5 - Review

Impressions from the conference

I had a lot to catch up on after Devcon. Also things didn't go quite as planned, so please excuse my delayed review! This year's Devcon was certainly stormy with a big typhoon warning already on day 1. Luckily (for us, not the people in Tokyo), it went right past Osaka. Nevertheless, a lot of...

Devcon 5 - Information, Events, Links, Telegram

What you need to know

Devcon 5 is coming up soon and there are already lots of events available, information about Osaka and more. Here is a short overview: Events Events Calendar Events Google Docs Events Kickback Most events are in all three, but if you really want to see all, you will have to look at all three...

Design Pattern Solidity: Off-chain beats on-chain

Why you should do as much as possible off-chain

As you might have realized, Ethereum transactions are anything but cheap. In particular, if you are computing complex things or storing a lot of data. That means sometimes we cannot put all logic inside Solidity. Instead, we can utilize off-chain computations to help us. A very simple example...

Design Pattern Solidity: Initialize Contract after Deployment

How to use the Initializable pattern

There are a few reasons why you might want to initialize a contract after deployment and not directly by passing constructor arguments. But first let's look at an example: contract MyCrowdsale { uint256 rate; function initialize(uint256 _rate) public { rate = _rate; } } What's the advantage over...

Consensys Blockchain Jobs Report

What the current blockchain job market looks like

Consensys published their blockchain jobs report which you can checkout in their Blockchain Developer Job Kit. The most interesting aspects are Blockchain developer jobs have been growing at a rate of 33x of the previous year according to LinkedIns jobs report Typical salary is about...

Provable — Randomness Oracle

How the Oraclize random number generator works

One particularly interesting approach by Provable is the usage of a hardware security device, namely the Ledger Nano S. It uses a trusted execution environment to generate random numbers and provides a Provable Connector Contract as interface. How to use the Provable Randomness Oracle? Use the...

Solidity Design Patterns: Multiply before Dividing

Why the correct order matters!

There has been a lot of progress since the beginning of Ethereum about best practices in Solidity. Unfortunately, I have the feeling that most of the knowledge is within the circle of experienced people and there aren’t that many online resources about it. That is why I would like to start this...

Devcon 5 Applications closing in one week

Devcon 5 Applications closing

Watch out for the Devcon 5 applications. You only have one week left to apply either as Buidler Student Scholarship Press Devcon is by far the biggest and most impressive Ethereum conference in the world. And it's full of developers! I am especially excited about the cool location this year in...

Randomness and the Blockchain

How to achieve secure randomness for Solidity smart contracts?

Update 2023 : Ethereum transitioned to Proof of Stake! If you are interested in the randomness there, you can now use the updated info over at https://soliditydeveloper.com/prevrandao. When we talk about randomness and blockchain, these are really two problems: How to generate randomness in smart...